Learn how to improve Experience, Expertise, Authoritativeness, and Trust (E-E-A-T) to strengthen your website’s credibility. Discover key strategies to increase trust and brand authority and improve your search performance in the competitive financial services sector.

Google’s algorithms prioritise helpful, reliable content. One of the key ways they assess this is through E-E-A-T (Experience, Expertise, Authoritativeness, and Trustworthiness). While not a direct ranking factor, E-E-A-T helps Google’s quality raters evaluate whether content deserves to rank—especially for sensitive topics like finance, health, or legal advice (known as YMYL – “Your Money or Your Life”).

If your website lacks E-E-A-T signals, it will be difficult to rank, no matter how well-optimised it is technically. Let’s break down what E-E-A-T means and how to improve it.

What is E-E-A-T, and Why Does it Matter for Financial Content?

Originally, Google used E-A-T (Expertise, Authoritativeness, Trustworthiness). The added “Experience” highlights the importance of first-hand knowledge – especially in fields where real-world practice matters.

Examples of E-E-A-T in action:

A “Best ISA Accounts 2024” guide written by Martin Lewis will outperform generic comparison content.

“How to Get Out of Debt” article by a licensed insolvency practitioner at StepChange carries more weight than AI-generated debt advice.

Google’s Guidelines (their internal manual for assessing content) state how content is rated. For financial content, it’s important to know that:

Expertise alone isn’t enough – readers need to trust your content.

AI-generated content without human oversight often underperforms.

YMYL sites (finance, health, law) face stricter scrutiny.

First-hand professional experience is paramnount

Formal qualifications should be included where applicable

(Source: Google’s Quality Rater Guidelines)

How Financial Websites Can Improve E-E-A-T Signals

Google values content creators with first-hand knowledge. Ways to improveDemonstrate E-E-A-T:

1. Demonstrating Real-World Experience.

Detailed author bios should be written for the authors of your content.

Strong example: “Sarah Doe is a certified CFA, has 15 years’ experience as a portfolio manager at Company Name, specialising in pensions and investments.”

Suboptimal example: “Our financial team” (no named experts or credentials)

Insights with real numbers, including real numbers and specific examples to support your claims.

Strong example: “How We Helped a Client Reduce Capital Gains Tax Liability by 17%” – you can also use anonymised but specific figures and be sure to include strategy details

Suboptimal example: “We save clients money on taxes” (no proof)

Original financial analysis provides unique insights rather than just repeating others’ predictions.

Strong example: “2024 UK Property Market Forecast” with exclusive Land Registry data analysis

Suboptimal example: Bringing up predictions from other sites without adding any value

2. Establishing Expertise:

Citing authoritative sources: Support claims with data from respected sources, such as government publications and industry reports. Cite FCA-approved sources, for example.

Strong example: Linking to Bank of England statistics or HMRC tax guidelines.

Suboptimal example: “Some experts believe…” with no sources.

Industry recognition and qualifications: Highlight certifications, awards, and speaking engagements to reinforce subject matter expertise.

Strong example: “Reviewed by Sarah Doe, Certified Financial Planner (CFP) and FCA Registered”.

Suboptimal example: No named or qualified author.

Keep content regulation-compliant: Maintain up-to-date content that reflects current industry trends and research.

Strong example: “Mortgage advice updated for 2024 FCA rules”.

Suboptimal example: Outdated pension contribution limits.

3. Building Authoritativeness:

Get featured in financial media: Secure mentions in reputable publications to enhance your reputation.

Strong example: Quoted in Financial Times, MoneySavingExpert or Bloomberg.

Suboptimal example: Only self-published content.

Publish in-depth financial guides: Consistently produce in-depth, valuable content.

Strong example: “The Complete Guide to Venture Capital Tax Reliefs (SEIS/EIS)” with case studies.

Suboptimal example: “Tax tips” listicles with no depth.

Strategic collaborations: Participate in industry-relevant collaborations and establish yourself as a trusted voice.

Strong example: Partnering with CFA UK for a webinar series.

Suboptimal example: No industry affiliations.

4. Prioritising Trustworthiness:

Transparent disclosure: Provide clear contact information, including a physical address, phone number, and email address. Add FCA firm reference number.

Strong example: Clear display of FCA firm reference number in the footer.

Suboptimal example: No regulatory status mentioned.

Transparent fees or commission: Ensure your website utilises HTTPS, features a robust privacy policy, and adheres to ethical SEO practices.

Strong example: “We charge 1% AUM fee”, clearly stated.

Suboptimal example: Hidden charges in small print.

Genuine customer feedback: Encourage and showcase authentic customer reviews and third-party testimonials.

Strong example: Verified Trustpilot reviews are displayed prominently on the homepage.

Suboptimal example: No customer testimonials or only anonymous reviews without verification.

Professional indemnity insurance: State your coverage to reassure clients of financial protection in case of errors or disputes.

Strong example: “Covered by £2m professional indemnity insurance”.

Suboptimal example: No protection mentioned.

Consistent brand narrative: Maintain a cohesive brand voice, visual style, and messaging across all online platforms to reinforce credibility.

Strong example: The website, social media, and emails use the same logo, colour scheme, and tone of voice.

Suboptimal example: The website has a professional tone, but social media posts are inconsistent and unprofessional.

Can AI Help with EEAT: Augmentation, Not Substitution

While AI tools can assist with content creation, they should not replace human expertise. Google has consistently emphasised the importance of “people-first” content. AI-written content can be superficial and undermine trust in your brand.

Examples of AI done right vs. wrong:

Good example: Using AI to help draft a content structure, then editing it by adding examples you’re your experience, expert commentary, and original research links.

Suboptimal example: Publishing AI-generated “Stock Picks” text without author, fact-checking or adding risk disclosures.

Common E-E-A-T Mistakes to Avoid

Opaque Contact Information: Concealing contact details raises suspicion. Provide clear contact information on a dedicated “Contact Us” page.

Superficial Content: Vague or generic content lacks depth. Focus on delivering original insights and practical advice.

Anonymous Authorship: Content without clear author attribution and credentials undermines credibility.

Inconsistent Brand Messaging: A lack of cohesive brand messaging erodes trust. Maintain a consistent brand narrative across all platforms.

How Financial Brands Master E-E-A-T: Real-World Success Stories

MoneySavingExpert (MSE): A Masterclass in E-E-A-T

MoneySavingExpert’s E-E-A-T strategy: Leveraging first-hand expertise and authoritative sources to build trust and credibility.

Organic search success:

MSE ranks in the top 10 for approximately 182,000 financial queries in the UK. Notably, it holds the 2nd spot for “mortgage calculator” – a highly competitive term with 550,000 monthly searches in the UK.

How they achieved it:

High-value content: Top-performing pages include detailed financial guides and interactive calculators.

Author transparency: Every article is attributed to named, verified authors (Verified via MSE’s News Section).

Industry recognition: Cited in FCA guidance (FG22/5) as a “good practice example” for consumer clarity.

Award-winning credibility: MSE has received numerous industry awards over the years, further solidifying trust.

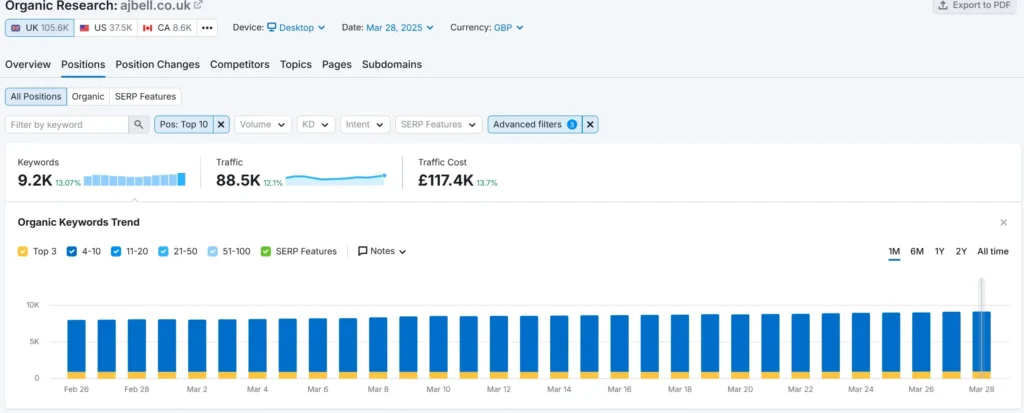

AJ Bell: Building Trust Through Transparency & Authority

AJ Bell’s E-E-A-T strategy: A commitment to transparent pricing and expert-driven financial insights to establish trust and authority.

Organic search success:

AJ Bell ranks in the top 10 for around 9,000 financial queries in the UK. It also holds the 1st position for “personal tax allowance” – a financial term with 9,000 monthly searches in the UK.

How they achieved it:

High-quality content: Top-performing pages feature detailed guides and financial news analysis.

Expert-authored articles: Every article is written by verified professionals, with clear author attribution and links to bios (Verified via AJ Bell Investment Articles).

Winner of the 2024 Times Money Mentor Award for Best Investment Platform.

Boring Money Awards (2024) for excellence in investment services.

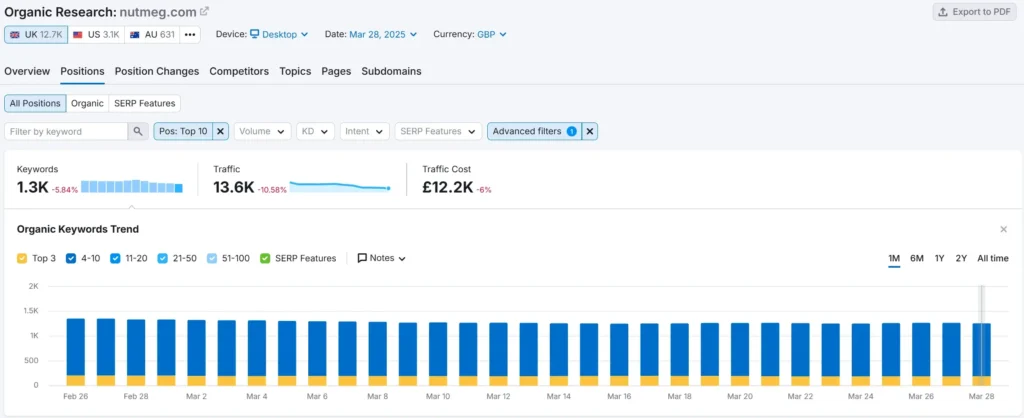

Nutmeg: Leading the Way in Investment Transparency

Nutmeg’s E-E-A-T strategy: Nutmeg builds trust through clear investment transparency and a commitment to FCA-backed innovation.

Organic search success:

Nutmeg ranks in the top 10 for approximately 1,300 UK financial queries, including 4th place for “self-employed tax calculator”, a highly searched term with nearly 15,000 UK monthly searches.

How they achieved it:

Data-driven tools: Top-performing content includes interactive calculators that provide instant financial insights.

Transparent pricing: Clear and accessible fee structure publicly displayed. View Fees

Regulatory trust signals: The FCA reference number is displayed in the footer across all pages, reinforcing compliance.

Winner of Boring Money Awards (2024) for excellence in investment services.

Key Takeaways

Optimising for E-E-A-T is a strategic investment, rather than a quick win, in building lasting credibility. Search algorithms reward high-quality, trustworthy content, ensuring long-term visibility and audience trust.

E-E-A-T helps Google assess content quality – especially for YMYL topics.

First-hand experience is critical.

Expertise, authoritativeness, and trust are demonstrated through content and credentials.

AI content requires human oversight and editorial refinement.

Long-term success stems from consistent, credible content creation.

FCA compliance is the baseline for trust.

Regulatory transparency is non-negotiable.

E-E-A-T Financial Checks You Can Implement Today

1. Display the FCA registration number in the Footer

2. Create or update author bios with qualifications (CFA, CFP, etc).

3. All articles have named authors with a link to the author’s bio

4. Include risk warnings on investment content

5. Display physical address and contact details in the Footer

6. Add a clear fee/commission structure page

7. Review content and update for regulatory changes

By applying these strategies, you’ll build a strong E-E-A-T foundation that will improve your online presence and strengthen trust with your audience.